I am finally (after 20+ years) in the position of having a number of credit cards with zero balances. I've been using an AMEX blue and paying it off every month, and not using the others (6 cards altogether). Would it be better to rotate the card on a monthly basis so they all get used? I would still pay the balance off every month. I've heard it's bad to cancel a credit card, so I don't want to do that.

It's all magic and smoke but unused credit is "potential" and too much of it hurts you according to common wisdom.

I think the real nut of it is... make a berkeley ton ton of money, use a little credit to let them know they are making money on you and never miss a payment and you are the gold standard.

Just pay your bills, be late once or twice and don't be living paycheck to paycheck and you are everybody between 500-750.

If you are less than 500 you know why.

My philosophy has always been to avoid debt, have a large pool of it available JIC though, and pay the bills but I pay no attention to strategy and I have berkeleyed up a few times. But, I have never, ever had as issue getting or using credit. I think if you are sensible and live within your means and leverage credit to get things done rather than to buy things you cannot afford ... it all works out regardless of the scheme under the covers.

It's a number that creditors use to assign risk to you. Think like a bank - would you loan you money? How confident are you that you won't max them all out at the first sign of trouble? Is that maximum already close to your ability to pay it back? Those are the kinds of answers they are looking to get.

codrus

SuperDork

12/28/16 10:35 a.m.

It's also "bad" to have more available credit than you'll actually use. Personally, I'd cancel a couple of the cards, get down to one card that you use for normal purchases and one as an emergency spare for when the first one gets lost or cancelled due to fraud or whatever.

My credit report has a "note" on it about a card I cancelled years ago. It's unclear to me whether that is being counted as a negative or not (see: magic and smoke), but that has me reluctant to cancel. I have 2 cards that have excessively high limits for some reason (what does Discover think I'm going to buy that costs $17,000??), I was thinking about asking for those to be lowered.

I have no plans to take out a loan for at least 4 years (and maybe not even then) so maybe anything I do now will be counteracted anyway?

I am determined to avoid more credit card debt, it got really dicy for a few years there.

In reply to codrus:

Actually, about 30% of the US credit score is utilisation and it's favourable if you use as little as possible. Usage of 50%+ of available credit tends to be considered a warning flag and is a good way to get ones credit limit lowered, thus making the problem even worse. Best way to bump up the score really high if one is so inclined is to have plenty of available credit and only use about 10% of it.

Unless you are trying to buy a house, "too much credit" isn't going to hurt your score. Too little will. If you're looking at buying a house and the underwriter thinks you have too much credit, they'll tell you.

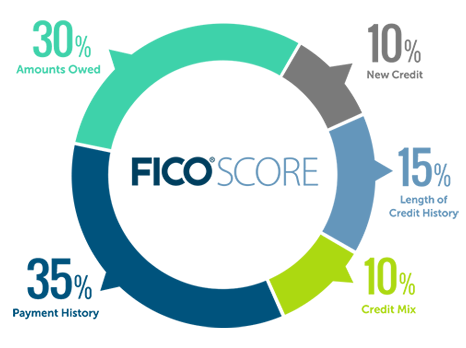

The credit scoring bureaus don't know and don't care about you living paycheck to paycheck. What they mainly care about is

- Do you pay your bills on time

- How much of your available credit you are using

There are a couple of smaller factors like the number of hard credit enquiries and the age of your history, but the two above make up approx 2/3rds of your score.

@slowride, if I were you and you care about your credit score, I would do precisely nothing other than making use of the cards you normally don't use 2-3 times of the year so they stay active. High credit limits don't hurt you unless you actually use them...

BTW, the credit bureaus also don't see and don't care that you pay your balance in full. Credit card issuers normally report the billed balance, so unless you pay your bill in full before the statement date, you are showing balances on your credit reports and there is no sign if you're paying in full or not. So obviously a credit hack is to pay down the balance before the statement date  .

.

Do you know what that 'note' says and how old it is? Also, you may want to sign up for credit karma - they give pretty good info about the factors going into your credit score with two of the tree bureaus. Plus IIRC Amex offers free 'real' credit scores to their customers.

Fico score is just another way of using the Transunion score. Pulled from the same everything just a different name.

I just jumped my scores over 150 points by being added as a user on my mom's discover card. 3% credit utilization, 10 accounts(on record only 2 are active), and now an average credit history of 10 years is one hell of a combination.

From that, no there really isn't such a thing as too much credit. The magic utilization number is under 30%, from most sources. Meaning my credit union, discover, credit karma, and Experian themselves.

The whole credit thing is just a smoke and mirrors bullE36 M3 game, but once you doggie out the rules, it's really easy to cheat and "win". This time last year I was holding a 525 score through Transunion. As of this morning 740. That's one hell of a jump for such a short time, just need to learn to play the game.

trucke

Dork

12/28/16 11:30 a.m.

If you cancel a credit card, make sure you tell them to print the statement 'cancelled by user'. This way it is documented that you cancelled it, it did not get cancelled by the creditor.

Thanks guys, this is all good info.

I think I have my old credit report that shows that note, I will have to look to get the exact wording. But it was definitely ambiguous. And it was quite a long time ago (10 years I think).

I have gotten the free FICO score from Discover a few months ago (note: 740 at that time), but not Amex. I will check that out.

That sending $5 is an interesting idea, I may try that!

RevRico wrote:

Fico score is just another way of using the Transunion score. Pulled from the same everything just a different name.

Minor point - Fico is a credit scoring system, Transunion is a credit bureau (one of the three major ones). Credit bureaus tend to use the FICO scoring system, but their scores don't necessarily match as not all lenders report to all bureaus.

slowride wrote:

Thanks guys, this is all good info.

I think I have my old credit report that shows that note, I will have to look to get the exact wording. But it was definitely ambiguous. And it was quite a long time ago (10 years I think).

I'd try to pull a current credit report in that case (or go look at creditkarma). A note that old shouldn't show up on a report anymore and even if it does it shouldn't affect your score.

In reply to BoxheadTim:

Discover card website said:

Understand how your FICO® Credit Score is determined.

Your FICO® Scores consider five categories of credit data from your Experian credit report that may vary in importance for different credit profiles. The percentages reflected are based on the five categories for the general population

When I looked 2 months ago it said transunion, now it says experian.

Kinda the same but different. I'm not arguing with you about it, I don't want it to seem that way, but it really looks like an arbitrary number that just gets publicity.

I make it a point to pull my yearly free score from all 3 major agencies when I file my taxes every year. It's "free" once per year, and tax time makes a good reminder. It might be a good habit for everyone to get into.

But having credit karma is nice for keeping up on the month to month, as my credit union reports the secured card every month instead of a few times a year like major credit cards do, leading to more drastic and closer to real time changes to my reports, both good and bad.

FICO is an independent company, formerly Fair, Isaac, & Co. They're a data analytics company that came up with the the algorithm behind the fico credit score. There's only one FICO score but there are multiple credit scores. All are roughly correlated but the actual ranges and values are different.

YES, rotate your usage between the credit cards so that you keep activity on all at some time. Under the present laws if you don't use it you lose it so if you quit using them then your credit limits will drop.

NO, conventional wisdom is wrong if you think it says you can have more credit than you can use, whatever that means.

Activity units (payments to you and I) will drive your scores so it's preferable from a credit score that you have 2-3 lower payments than 1 larger payment of the same dollar total. So use all your cards a little

In reply to JohnRW1621:

The $5 a month idea is brilliant, and I have a card with a $0 balance that I have not closed due to concern that it would lower my credit score to close an older account. I am going to start doing this and when they send me my check at the wnd of the year I will deposit that into my IRA. BooYA. I will never miss $5/month.

Thanks dude.  Cheers

Cheers

When I briefly worked for a credit union 16 yrs ago they told me they had their own internal scoring.

In reply to EastCoastMojo:

I can't prove that these small payments help but I swear they do.

I would have learned this trick on the Internet and Im pretty sure I learned it here on GRM. I seem to remember that someone here once worked as a Credit Repair Counselor.

In reply to JohnRW1621:

Well, it makes some sense though. They are reporting positively on me every month and I have zero risk since there's no balance for me to be late in paying for. I don't really need to bump up my score, but I figure it really can't hurt to try it and if nothing else will give me a check at the end of the year that I can add to retirement savings. I have learned lots about financial strategies on this forum and this is another example of that.

Here is another credit trick I know I learned of on GRM.

Pre screen opt out

This will not change or affect your credit score but it has greatly reduced my junk mail!!!