RevRico

PowerDork

9/3/19 10:12 a.m.

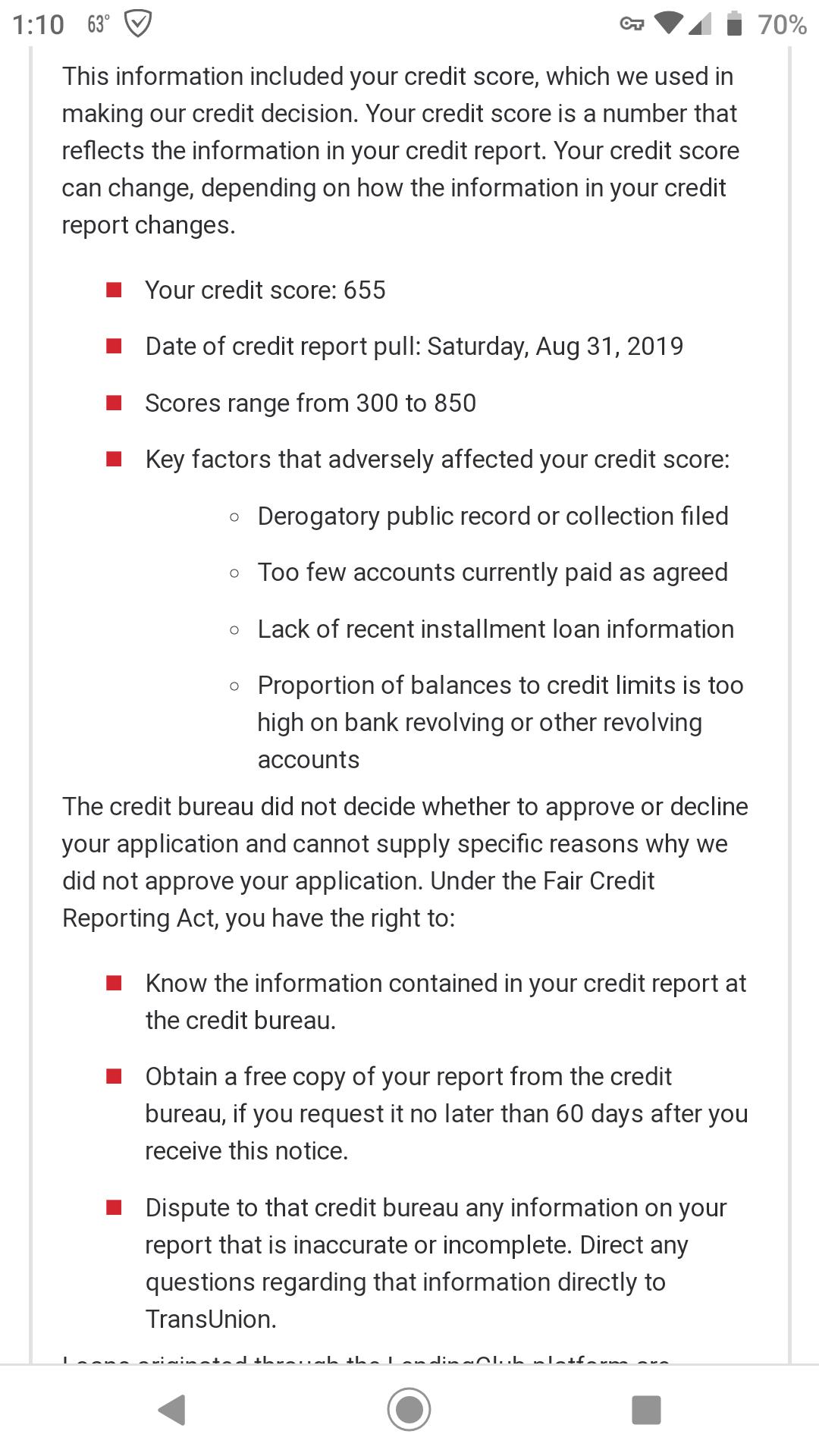

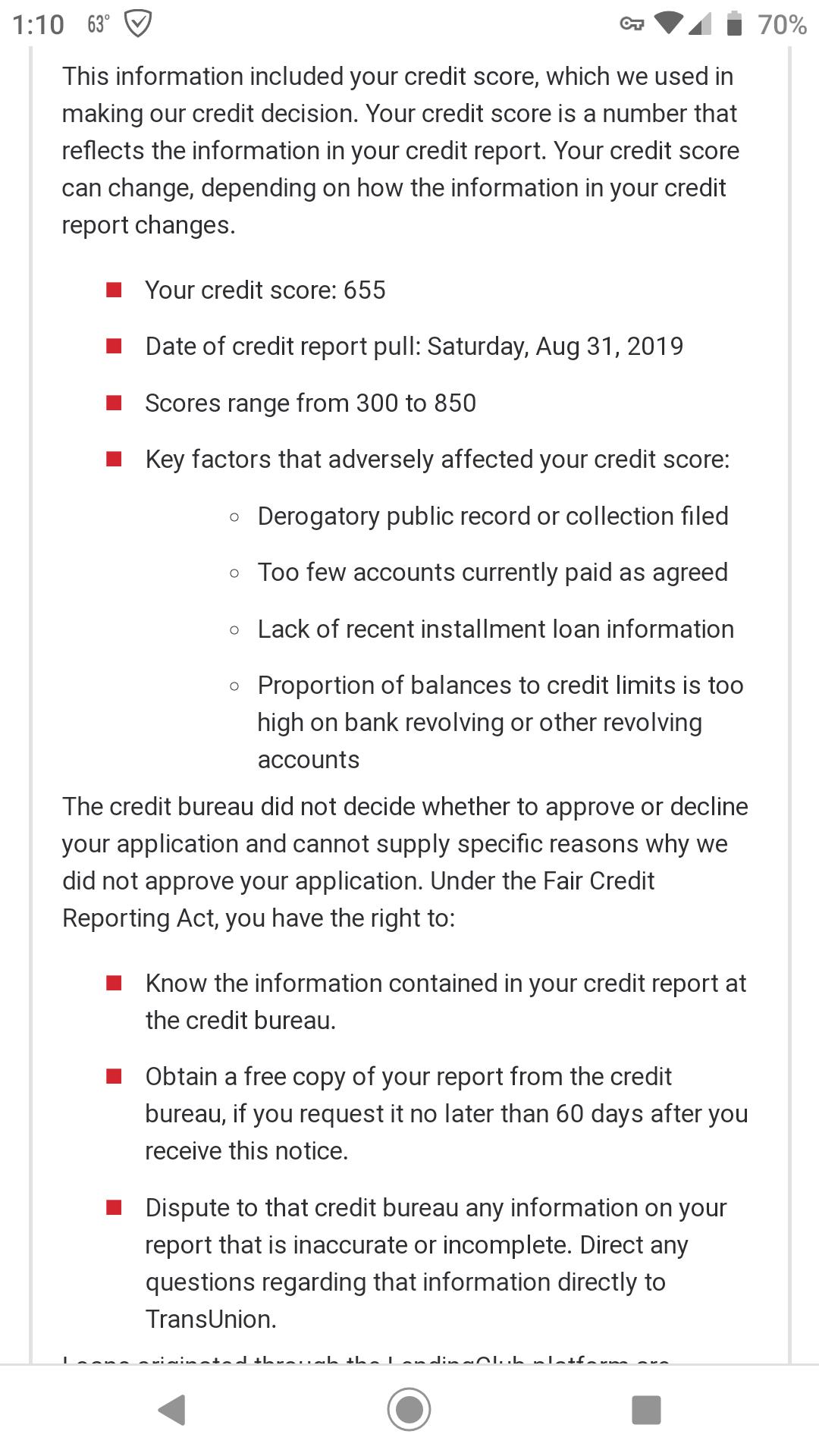

So over the weekend, I tried out something on credit karma, to see from curiosity if I could be preapproved for a loan I don't really need. It was a soft inquiry, and I was denied from a few places and offered at ridiculous interest rates at others.

But one of my rejection letters confuses me. Now, the main reason I was rejected was because of my lack of income relative to the size of the loan, I get that part. This is the part I don't understand.

^^ screenshot from my rejection letter. Almost makes sense until I look at my Transunion section on credit karma.

There's a 100 point difference in Transunion scores of the same day. There are also no derogatory remarks. There was, in 2017, a collections claim from progressive for $135 I paid immediately that I never received a bill for prior, but nothing else bad in the past 10 years.

Are they even looking at the same Transunion "soft report" that I am? Is credit karma padding my stats to make me feel better? And if all my accounts are paid up every month, how do I have accounts that aren't paid as agreed?

How do you know the 655 was a TransUnion score?

Yes, Transunion may be showing you at 757 but what are the other reporting agencies showing your score as?

Wiki tells me this about Credit Karma:

Credit Karma provides free credit scores and credit reports from national credit bureaus TransUnion and Equifax, alongside daily credit monitoring from TransUnion.[9] Users can see updates to their credit scores and credit reports on Credit Karma once a week.

It seems to me that CK's bigger relationship is with TransUnion and can get daily info from TransUnion only. However there seems to be nothing about Experian. The potential lender may have run you through Experian.

RevRico

PowerDork

9/3/19 10:32 a.m.

In reply to John Welsh :

Wrong screen shot

my Equifax is actually better because they seem to only get updated every other month. I don't know my Experian score come to think of it.

my Equifax is actually better because they seem to only get updated every other month. I don't know my Experian score come to think of it.

You should contest the collections charge and get, in writing, a statement that you discharged the debt and submit that to the agencies.

There is some new system some creditors are using with ridiculous scores, regarding the loan approval part of it.

I found the opposite happen on Credit Karma, the day I got the Mazda 3 back in June, it showed me having a ~770 credit score. When the dealership ran my credit, they showed it at 807.

It's all a scam to me.

RevRico

PowerDork

9/3/19 10:41 a.m.

z31maniac said:

It's all a scam to me.

that's exactly what I think of the whole credit thing in a nutshell, I'm just starting to pay more attention to it because unless I want to wait 2 years for my business to earn business credit, which is an entirely different scam, my personal credit is going to come into play next year.

I feel better having cheated the system a bit by being added as a user to my mom's discover card (instant 125+ point jump), but it's still annoying and confusing.

Credit Karma has a credit score simulator, whereas lenders obviously are able to pull from the bureaus directly. There is also not one single credit score, apparently it depends a bit on the usage and type of enquiry.

My CK scores are consistently high compared to the ones I get via my credit cards, not to the extent that you've seen but still in the 40-50 points range. The difference has been getting a little smaller recently, but it's not great.

If I were you I'd pull the Transunion report (you can do that for free once a year via annualcreditreport.com (check the URL, I think I typed it correctly - there are a bunch of shady ones out there) and have a look if there is something on there that shouldn't be.

RevRico

PowerDork

9/3/19 10:44 a.m.

Brett_Murphy said:

You should contest the collections charge and get, in writing, a statement that you discharged the debt and submit that to the agencies.

How? When I review my actual full credit report I see things like store credit cards and loans that were closed in good faith or due to lack of use over a decade ago still appearing. They don't seem to have a positive or negative affect, but I thought this was a 7 year thing?

RevRico said:

Brett_Murphy said:

You should contest the collections charge and get, in writing, a statement that you discharged the debt and submit that to the agencies.

How? When I review my actual full credit report I see things like store credit cards and loans that were closed in good faith or due to lack of use over a decade ago still appearing. They don't seem to have a positive or negative affect, but I thought this was a 7 year thing?

IIRC they can't be used for negative or positive impact, but that doesn|t mean they have to fall off, as long as they're showing as closed.

Does the collection item actually show on the report?

mtn

MegaDork

9/3/19 10:48 a.m.

I work in the financial industry, and have been involved in risk-acceptance for businesses and individuals with low credit scores.

I cannot for the life of me figure out how the scores are calculated and how I can go to 3 different free credit score systems (through my banks/credit cards) and have 3 numbers that are as far apart as they are. I'm not sure if the differences are statistically significant or not, but it still boggles the mind.

I was also impressed with how fast you can make a credit score recover, if you have the resources. My wife didn't manage her credit cards as well as she should have, and what is worse, as well as she could have and would have had she just paid attention. Hurt her score, and we got it back up in about 3 months. She wasn't really in a hole though, more just a divot.

In reply to RevRico :

A while back on GRM I had written extensively about sending in $5 payments when there is no bill. I looked up the thread and it turns out I wrote that thread for you:

https://grassrootsmotorsports.com/forum/build-projects-and-project-cars/rebuilding-revs-credit/121063/page1/

Above you mention that they are closing your accounts for inactivity. That might not be good. Send them $5 (which you get back) and you will have activity. And, positive activity seems to be the name of the game.

RevRico

PowerDork

9/3/19 10:55 a.m.

In reply to BoxheadTim :

It does appear, last reported November 2017, with an open date of August 2014. Status closed but no closed date, with a remark "paid collection". I got a phone call one day from an agency saying I owed progressive money, paid them immediately, but never actually got a bill or anything when I cancelled my car insurance and moved back to PA in summer of 2014.

Other wise, I have one payment that was 35 days late on an account that closed April of 2015. Everything else is positive.

Even the capital one card and best buy card that I got screwed extremely extremely hard on are both off my report entirely, finally. Turns out every time one of those got sold to a collection agency, they started over at the full amount, negating anything I had paid towards it to previous collections companies. $3500 in debt cost me almost $20k by the time it was all paid off.

z31maniac said:

There is some new system some creditors are using with ridiculous scores, regarding the loan approval part of it.

I found the opposite happen on Credit Karma, the day I got the Mazda 3 back in June, it showed me having a ~770 credit score. When the dealership ran my credit, they showed it at 807.

It's all a scam to me.

I have notices something similar. The score I get from Discover (which is always on my page on their website / app) was noticeably different than one run by a dealership (825 - 845, yes I have ridiculous credit... because I have little need for it).

John Welsh said:

Above you mention that they are closing your accounts for inactivity. That might not be good. Send them $5 (which you get back) and you will have activity. And, positive activity seems to be the name of the game.

If they were real credit cards and not store cards, that definitely hurts the credit standing because the percentage of credit used went up.

RevRico

PowerDork

9/3/19 11:03 a.m.

John Welsh said:

In reply to RevRico :

A while back on GRM I had written extensively about sending in $5 payments when there is no bill. I looked up the thread and it turns out I wrote that thread for you:

https://grassrootsmotorsports.com/forum/build-projects-and-project-cars/rebuilding-revs-credit/121063/page1/

Above you mention that they are closing your accounts for inactivity. That might not be good. Send them $5 (which you get back) and you will have activity. And, positive activity seems to be the name of the game.

Everything I have in my name that's opened right now is used monthly, I forgot I detailed it out in that thread. My secured credit card from the credit union pays my phone bill and carries a ~30% balance every month, the discover card paid for the remodel and monthly medications and usually revolves $500 of the $14k limit.

The JB Robinson card was closed to inactivity because I quit buying girls jewelry back in 09. It just surprises me to see it popping up now.

I haven't opened any new accounts yet, but I'm looking really hard at getting a loan through AgriFab or whoever they are for a tractor next year. They're used to dealing with farmers with spotty credit and income history, hoping my good credit and business license will net me one so I can start showing real income instead of the $17.5k/year I make right now.

Credit scores are like adjustable shocks or automatic transmissions. Nobody knows how they work. Anyone who claims they do, is completely full of E36 M3.

RevRico said:

Brett_Murphy said:

You should contest the collections charge and get, in writing, a statement that you discharged the debt and submit that to the agencies.

How? When I review my actual full credit report I see things like store credit cards and loans that were closed in good faith or due to lack of use over a decade ago still appearing. They don't seem to have a positive or negative affect, but I thought this was a 7 year thing?

You can contest anything on a credit report. There are multiple articles on how to do this.

I just now pulled another free report and wanted to show a update to my $5 payments. I have edited my posting over in this other thread as a way to save this info but not bring that thread back up to the forefront where it might get confused with this current thread.

https://grassrootsmotorsports.com/forum/build-projects-and-project-cars/rebuilding-revs-credit/121063/page1/

Credit Karma is a simulator and not an actual score, it is an estimate of what your score "should" be.

More than 90% of lenders prefer the FICO scoring model, but Credit Karma uses the Vantage 3.0 scoring model. ... Overall, your Credit Karma score is an accuratemetric that will help you monitor your credit — but it might not match the FICO scores a lender looks at before giving you a loan

RevRico said:

that's exactly what I think of the whole credit thing in a nutshell, I'm just starting to pay more attention to it because unless I want to wait 2 years for my business to earn business credit, which is an entirely different scam, my personal credit is going to come into play next year.

I feel better having cheated the system a bit by being added as a user to my mom's discover card (instant 125+ point jump), but it's still annoying and confusing.

You self employed? You have no credit, dude. If you have an employee who shows up drunk twice a week, and has been in jail for dealing Meth, well, he has a better chance of borrowing money than you do.

Cooter

UltraDork

9/3/19 2:37 p.m.

The whole credit fiasco is hilarious to me. My wife just told last night me that Experian reported my credit rating has jumped to 836.

I have been off work for 3 months this year and I had told Citibank they could take my house back in 2009 when they refused to offer me a loan modification or even a couple months' relief to get back on my feet after my local trade collapsed. (They said they wouldn't do anything because I had never missed a payment in 17 years. I told them to get ready, as they were never going to see another dollar from me) The hilarity continued when Visa sent me a offer for The Black Card two months after I was laid off in '09.

There is no rhyme or reason to any of it, IMO.

mtn

MegaDork

9/3/19 2:58 p.m.

Cooter said:

The whole credit fiasco is hilarious to me. My wife just told last night me that Experian reported my credit rating has jumped to 836.

I have been off work for 3 months this year and I had told Citibank they could take my house back in 2009 when they refused to offer me a loan modification or even a couple months' relief to get back on my feet after my local trade collapsed. (They said they wouldn't do anything because I had never missed a payment in 17 years. I told them to get ready, as they were never going to see another dollar from me) The hilarity continued when Visa sent me a offer for The Black Card two months after I was laid off in '09.

There is no rhyme or reason to any of it, IMO.

This stuff kinda makes sense. Sort of.

Citibank wouldn't offer you a loan modification because you didn't fit their criteria, one of which was probably "has missed a payment" or "late payment". Their criteria probably should have included "significant loss of income", but from their perspective if they did something outside what was spelled out and approved by the various committees, including risk committees, they'd be putting themselves at risk for audit findings. Obviously a case of left hand not talking to the right, because the other hand of it is that if they had gone off of their approved processes they probably could have had a better overall outcome, at least for the loan in question if not their entire portfolio.

Also, unless you notified Visa that you had lost your job and/or updated your income, they would have only seen that you had a reasonable income and were making payments on time every month, probably in full. The exact customer that they'd want for their Black Card. The offer was not an approval, they still coudl have denied you.

We paid off some credit cards and my credit score went up because my ratio of available credit to the amount being used went down.

We left those cards open so I my percentage of debt to available credit went down, right?

Then a month or so later we canceled those cards therefore reducing "available credit". I figured fewer open credit cards less chance for fraud.

But my credit score went down because the ratio changed, I was using a higher percentage of "available" credit.

They didn't seem to care at all about the size of my total debt going down, only that my available credit went down. This is with no late payments on my record for years. It took about 6 months to go back up to my usual 750 or so.

I just bought a truck. Credit score 757. I get a good rate. Then I got a notice my credit rating went down because, wait for it, my ratio of available credit to debt percentage went up. Grrrrrr.

Timely thread.

When I bought my house in July they pulled my credit and conveniently got a 797, putting me under the top-tier for rates. I pulled my credit report and score on the same day from the same company (TransUnion) and got an 808.  I pulled Experian and got an 818.

I pulled Experian and got an 818.

I checked my score today on my CC's estimator, and it dropped from 801 to 694 because my available credit went from 18% to 36%. Funny, the only actual change I had was adding a berking mortgage., and I know that sucker is more than 18% of my credit.

So, yeah, it seems like it's all computer-alorithm now and either useless or a scam. Whatever, I'm not going to need it again anyways.

my Equifax is actually better because they seem to only get updated every other month. I don't know my Experian score come to think of it.

my Equifax is actually better because they seem to only get updated every other month. I don't know my Experian score come to think of it.