Robbie

PowerDork

4/16/18 2:46 p.m.

frenchyd said:

Robbie said:

In reply to Ian F :

Well, basically any money you 'make' and then pay in taxes will always feel like 'too much', so that is why I believe I pay for an 'ass-load'. Remember I said I 'believe' I am rich and I 'believe' I pay a lot in taxes. After that, the 'truth' doesn't really matter. However, since I like numbers, I did a quick average by searching for the US 2017 tax revenue (3.32 T), and divided it by 300 M people (a hack for easy numbers), and got about $11,000 tax revenue per person (not per tax payer). We're well above average...

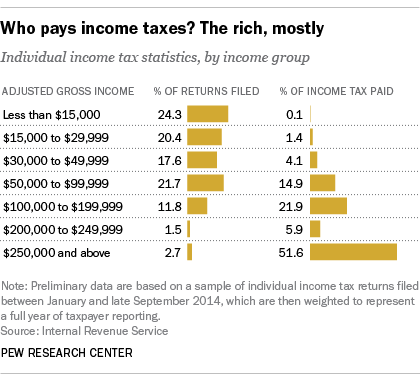

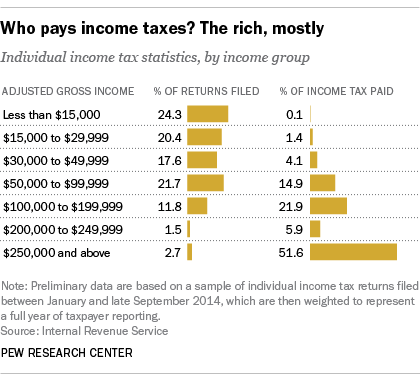

Also, I just found this. PEW research is generally well respected. Funny how the top 20% of incomes pay the top 80% of taxes, or maybe exactly as expected, I guess.

I’m sorry but $250,000 income doesn’t get you in the one percent club. And dollars of tax paid has almost nothing to do with real wealth. One rather famous person refuses to make his tax records available. According to rumors because he doesn’t pay taxes. Taking fulll advantage of those 77,000+ pages of the tax code and hiring those $1000 hour tax lawyers to find the legal precedent which allows him to.

I guess I don't see your point. top 1% income-wise (US) is like 380k-450k depending on if you look at individual or family. So, yes, not 250, but not that far off either. 250k in US is DEFINITELY in the top 1% worldwide. Actually, $32,400 in US puts you in the top 1% worldwide. So your $20/hour is plenty to get you there. There is also the bigger issue that income is not net worth, and has already been stated we are taxing income.

About anyone else's individual taxes... I guess I have to refer you back to my earlier point. At some point it just comes down to what you choose to believe.

Enyar

SuperDork

4/16/18 2:50 p.m.

frenchyd said:

In reply to SVreX : First I didn’t suggest eliminating a multi billionaire, just using one of his billions.

Second the concept of the needs of the one versus the needs of the many is easily understood. Don’t like my numbers? OK let’s use your numbers to make the point of discussion.

Third I have no problem with people getting wealthy from their efforts. I admire the Henry Ford, Bill Gates, Warren Buffet, etc.

My issue is with inherited wealth. Entitlements because your great grandfather worked hard and created wealth.

Because wealth equals power. The more removed from the creation of wealth the greater the likelihood of a lack of reality.

A simple example of a lack of reality is art! Not it’s creation. The collection of art. Where absolutely silly prices are paid for art. Why? Because you can show off what you can have that others can’t. What entitles you to collect art? Money!!!

I’m better than you because I have more money.

If you're a big fan of the estate tax just say so. Unfortunately, the amount of estates subject to the estate tax is near nothing. Too many ways around it and not enough transparency.

Abe Lincoln once said "don't hate the playa, hate the game" and I wholeheartedly agree with that. You can't just take a billion bucks from someone because they played by the rules and made out like a bandit. You can however change future tax policy in an attempt to stop widening of the wealth gap. If you believe that the answer is with the estate tax then so be it!

$250k in annual income is top 3% of household income in the US. Anyone consistently making that kind of income is rich. If they've made it for several years and are not wealthy then they are rich and foolish with their money.

SVreX

MegaDork

4/16/18 3:30 p.m.

In reply to GameboyRMH :

I read your third article. As I suspected, it's completely irrelevant too.

Its an article about the WORLD'S billionaires. We are discussing whether rich people in the US pay taxes.

You're right. The sampling size was 2437. But there are only 550 US billionaires, with a combined total net worth of only $2.4 trillion. I don't think they are holding $1.7 trillion in cash.

I'll be happy to agree with you on facts, but it would be really helpful if you would keep them relevant.

You seem to be really upset that there are some people in the world with a great deal of wealth.

SVreX

MegaDork

4/16/18 3:33 p.m.

In reply to frenchyd :

Ok, so your issue is with inherited wealth. May I suggest you start a thread about that?

Since US taxes are based on income, inherited wealth is not relevant to this discussion, because no one owes taxes on inherited wealth.

Toebra

HalfDork

4/16/18 3:37 p.m.

Do rich people pay taxes or pay income tax? It is not the same thing

Yes, they pay most of the taxes, but really rich people don't work, their income is from investments, which is taxed differently.

A problem with inherited wealth? If someone works hard and saves money, how could you possibly think it is not fair for them to decide what to do with the money?

dculberson said:

$250k in annual income is top 3% of household income in the US. Anyone consistently making that kind of income is rich. If they've made it for several years and are not wealthy then they are rich and foolish with their money.

It simply is the top percentage of people paying taxes. Not of the wealthiest people in the country.

How many of the 77,000+ pages of the tax code did you read to do your taxes? How many hours did a Tax attorney charging $1000 an hour did you pay to ensure you didn’t pay anything more than is required?

There are rules and then there here are rules. We aren’t even in the same game as the 1%

SVreX

MegaDork

4/16/18 3:39 p.m.

In reply to Toebra :

1st post says income tax.

The rest of the thread says all kind should of other stuff.

Enyar

SuperDork

4/16/18 3:48 p.m.

frenchyd said:

dculberson said:

$250k in annual income is top 3% of household income in the US. Anyone consistently making that kind of income is rich. If they've made it for several years and are not wealthy then they are rich and foolish with their money.

It simply is the top percentage of people paying taxes. Not of the wealthiest people in the country.

How many of the 77,000+ pages of the tax code did you read to do your taxes? How many hours did a Tax attorney charging $1000 an hour did you pay to ensure you didn’t pay anything more than is required?

There are rules and then there here are rules. We aren’t even in the same game as the 1%

I'm that tax accountant you keep talking about! I'd like to think I'm fairly familiar!

Even with all these loopholes you speak of I still ended up with a 17% effective tax rate. Not only that, I filed with Credit Karma online(only because I didn't want to pay for TurboTax). I must be a bad accountant since I didn't get it down to 0%.

Enyar

SuperDork

4/16/18 3:52 p.m.

frenchyd said:

dculberson said:

$250k in annual income is top 3% of household income in the US. Anyone consistently making that kind of income is rich. If they've made it for several years and are not wealthy then they are rich and foolish with their money.

It simply is the top percentage of people paying taxes. Not of the wealthiest people in the country.

How many of the 77,000+ pages of the tax code did you read to do your taxes? How many hours did a Tax attorney charging $1000 an hour did you pay to ensure you didn’t pay anything more than is required?

There are rules and then there here are rules. We aren’t even in the same game as the 1%

It's not just people paying taxes. It's people filing tax returns which includes incomes of all levels. If they didn't have income that's another story, but if you're in the top 1% you have income. As for the people not filing returns, the IRS isn't the friendliest bunch and they aren't happy when it comes to tax evasion. Good luck to those folks!

Toebra

HalfDork

4/16/18 4:00 p.m.

I would not have a problem with paying taxes if I thought they would spend the money wisely, like on fast cars or loose women, but the money will be spent in a much more profligate fashion, and I am not okay with that.

frenchyd said:

dculberson said:

$250k in annual income is top 3% of household income in the US. Anyone consistently making that kind of income is rich. If they've made it for several years and are not wealthy then they are rich and foolish with their money.

It simply is the top percentage of people paying taxes. Not of the wealthiest people in the country.

How many of the 77,000+ pages of the tax code did you read to do your taxes? How many hours did a Tax attorney charging $1000 an hour did you pay to ensure you didn’t pay anything more than is required?

There are rules and then there here are rules. We aren’t even in the same game as the 1%

It really sounds like you have very few responses to threads like this, and hit copy -> paste to answer them. Your response almost seems unrelated to the post you quoted in making it! What does a $1000/hr attorney have to do with it?

Cotton

PowerDork

4/16/18 4:28 p.m.

dculberson said:

$250k in annual income is top 3% of household income in the US. Anyone consistently making that kind of income is rich. If they've made it for several years and are not wealthy then they are rich and foolish with their money.

People have different definitions of ‘rich’. I would consider 250k annual far from rich.

In reply to Enyar : Warren Buffet pointed out how easy it would be for him to evade paying taxes.

I give him credit that he pays what he owes and is still the 2 nd richest person in America.

However you showed taxable income. Not total profit.

People hire $1000 /hr Tax attorneys because they want to avoid paying taxes if they can. Popular ways to avoid paying taxes is exactly what Warren Buffet explained( and that’s only one way)

sending income out of the country is another common way, reinvesting, another etc. putting assets in the company and treating it like an expense is another.

SVreX

MegaDork

4/16/18 4:40 p.m.

In reply to Cotton :

That's true. None of us know what "rich" is.

Generally, "rich" has to do with net worth, not income.

But 1% is a reference to the top 1% of wage earners. If you live in Alabama, that might mean $228,000. If you live in Connecticut, its $677,000. Nationwide, its $385,000.

Money Crashers definition of rich

Enyar

SuperDork

4/16/18 4:59 p.m.

Cotton said:

dculberson said:

$250k in annual income is top 3% of household income in the US. Anyone consistently making that kind of income is rich. If they've made it for several years and are not wealthy then they are rich and foolish with their money.

People have different definitions of ‘rich’. I would consider 250k annual far from rich.

This is true, just like how people have different definitions of what a good cup of coffee is. But statistically, 250k gets you in the top 3% so you're definitely far better off than the rest of us. I think a lot of people forget how fortunate we are, especially in this group which is a bunch of folks that race cars for fun.

Enyar

SuperDork

4/16/18 5:07 p.m.

frenchyd said:

In reply to Enyar : Warren Buffet pointed out how easy it would be for him to evade paying taxes.

I give him credit that he pays what he owes and is still the 2 nd richest person in America.

However you showed taxable income. Not total profit.

People hire $1000 /hr Tax attorneys because they want to avoid paying taxes if they can. Popular ways to avoid paying taxes is exactly what Warren Buffet explained( and that’s only one way)

sending income out of the country is another common way, reinvesting, another etc. putting assets in the company and treating it like an expense is another.

You keep mentioning this mystery method but never actually say what he does. Enlighten us all.

Shot answer yes we do.

Yes it suck and yes it is a higher percentage then people who make less then say. But there is a fallacy here as being rich is NET worth not yearly income. On my long term networth based investing I pay almost nothing until I cash out and even then it is a significantly reduced rate then income. Which is how it should be as I already paid taxes on the money I invested. Same with tax deferred. If I could put 5x into a 401K that I do right now for the tax benefit I would do it 5 seconds.

Effective total tax rate for me is 27% after all deductions on income not counting investments. Its 19% or so with investment income included I think.

This is a metric E36 M3 pile of money each year and I do not see the benefits at all directly. I am exactly what the government wants, I pay my taxes and I don't use any services beyond roads and the stuff we all pay for.

I can tell you the only way people think they are rich is if they have twice as much as they do right at this moment. Even then it only lasts a while then you want twice over again. By all accounts at my age I am easily 1%, if you count investment income in the mix then I am 1% in almost every context. I do not feel that way, I feel middle class at best which goes to show how people further down the line can feel like they get hit at every opportunity and that someone like me is above all of it.

SVreX said:

In reply to GameboyRMH :

I read your third article. As I suspected, it's completely irrelevant too.

Its an article about the WORLD'S billionaires. We are discussing whether rich people in the US pay taxes.

I didn't know we were being so specific, but if we assume those billionaires have an equal share of the hoarded wealth (probably underestimating the wealth of the US billionaires), then those 550 people are probably hoarding around $382B between them, more than $1k for every man, woman and child in the US, just in cash that's locked out of the economy.

SVreX said:

In reply to GameboyRMH :

You seem to be really upset that there are some people in the world with a great deal of wealth.

That's essentially correct, if oversimplified. I find it horrific that a few people have hoarded such a ridiculous proportion of the planet's wealth. That money was gained by exploiting the labor of the majority of the world's population and claiming other people's productivity for themselves, as you would see in my last link. The people amassing this wealth are regular human beings just like the ones they're exploiting, there is nothing they can do to morally justify this even if our economic system says everything is as it should be. The free market is essentially a "paperclip maximizer" AI that is completely indifferent to human suffering, and the 1% are its (perhaps unwitting) human collaborators. I don't know how anyone could look at these incredible moral horrors and think "this is fine."

In reply to GameboyRMH :

I find your way if thinking so fundamentally wrong. I just...I can't even

Nick Comstock said:

In reply to GameboyRMH :

I find your way if thinking so fundamentally wrong. I just...I can't even

It sounds to me like you may subscribe to what I call the "charity theory of economics." Under this theory, when rich people collect some critical mass of money, they donate jobs to us little people out of the goodness of their hearts, and if they aren't stupendously rich enough they won't donate those jobs. It's never explicitly stated that way, but that's how it's implied.

But they're not running a charity, they're getting more out of us than they're putting in or they wouldn't be doing it. Ideally they should get out just a fair bit more than they put in, but since the beginning of the computer age, instead of taking a fairly small cut they're locked our pay to about the same inflation-adjusted value and began taking a larger and larger cut with increases in productivity.

Mainstream society raises people to think that questioning the basics of our economic system is blasphemous. Again, never stated, but heavily implied. It even tries to teach us that there's something inherently morally good about turning a profit. But if you examine it closely you'll find that it's just a game with goals that are orthogonal and indifferent to human wellbeing...a game we all stake our lives on unfortunately.

In reply to GameboyRMH :

At the risk of getting sucked into this and I've tried to stay out as it's been made clear to me that my opinions are not welcomed here I will say this, I am of the opinion that what a man does with his wealth is his business and I expect nothing at all from him and I do not feel he is under any obligation to do anything whatsoever for the betterment of society.

Cotton said:

dculberson said:

$250k in annual income is top 3% of household income in the US. Anyone consistently making that kind of income is rich. If they've made it for several years and are not wealthy then they are rich and foolish with their money.

People have different definitions of ‘rich’. I would consider 250k annual far from rich.

With a strongly relative word like "rich," I guess there's no way to come up with an absolute definition for it. But to me, earning more than 97% of the people in the richest country on earth is a pretty good starting point. My assumption, too, is that you didn't wake up one morning earning $250k but instead have spent years getting there, earning loads of money but not quite $250k. So you should have a comfortable financial cushion - again unless you're foolish with your money as I stated previously. You should have liquid assets in the high six figures for sure at that point, and would be well into the millions if you put your mind to it. Those two figures combined put you way beyond the 1% on a global scale.

Ian F

MegaDork

4/16/18 8:16 p.m.

Robbie said:

In reply to Ian F :

Well, basically any money you 'make' and then pay in taxes will always feel like 'too much', so that is why I believe I pay for an 'ass-load'. Remember I said I 'believe' I am rich and I 'believe' I pay a lot in taxes. After that, the 'truth' doesn't really matter. However, since I like numbers, I did a quick average by searching for the US 2017 tax revenue (3.32 T), and divided it by 300 M people (a hack for easy numbers), and got about $11,000 tax revenue per person (not per tax payer). We're well above average...

I guess I just don't think of it that way. As I sit here finishing my taxes and staring at my W2 right now, I don't feel like I paid that much in taxes as a percentage of my income. Naturally, I want to pay less and I accept my refund for overpaying, but the actual payments don't make me angry. As much as my tax money may go towards programs I don't approve of, there are still many that I do approve of. I like having roads to drive on. I like having the arts and NASA funded. And so on.

Maybe it's because I've grown up with parents and friends in civil service positions, I don't consider taxes wasted. Is there waste? Of course. But there is waste in any financial system. There is waste in my own finances. There is waste in my company's finances. There is waste in government finances. It's just the differences in scale that makes govt waste so eye-watering. Naturally, waste should be reduced whenever it can be, but waste is somewhat natural and shouldn't be vilified. It's also a misconception that govt employees all spend with wanton abandon. My mother was a contract negotiator (buyer) for the military. True to her Quaker roots, she worked hard to save money where she could. To her it was not just govt money - it was her money. Which it was. She actually won awards for saving the govt money before she retired. Beyond that I still have many friends who currently work in civil service, just trying to get through the work day like the rest of us. There are more who care than many seem to believe, although I can say they are somewhat tested under the current environment. So a lot of govt criticism hits home for me.