Pay off debt. What's the interest rate on your mortgage? If you can pay that off and still have leftovers, I'd do that too.

Don't lock into CD's or anything fixed right now. Rates are crap, but they are going UP!

I like the real estate idea. Sure the market is up right now, but so is everything else. Checked the price of gold lately? I can remember when it was like $350 an ounce.

Sonic

UberDork

3/18/22 10:08 a.m.

STM317 said:

There is no safe, liquid option that's going to keep up with inflation so you have to prioritize. Sitting in a bank is safe and as liquid as can be, but it's going to be eroded by inflation. There are other options, but they're less safe, and/or less liquid

There is, look up I bonds from the US treasury. Government subsidized to match inflation and close to liquid (can get it back in a few days) and really the safest possible investment. For many years now these were not worth it but now they are. I have $10k there just as an emergency fund that is not just sitting in checking.

First of all, I'm really glad that I posted here, because there's a lot of great ideas. Thanks!

I'm in Oakland, CA. Real estate is insane. People are paying North of a Million dollars for 1200 sq ft bungalows in less than stellar neighborhoods (Kinda funny because California bashing on the internet is such a popular pastime). We're due for a correction, so like the stock market I'm kinda jittery on that one. On the other hand I've got a cousin with the golden touch in real estate, and it's possible that he'll have ideas. One that springs to mind is a chronically empty house in my neighborhood. The woman who owns it is nice but a little crazy. How would she respond to a wad of bills? I dunno, but if I'm gonna restore a house, one that sits a couple hundred feet from my own might be a good place to start.

But frankly that's a longshot.

The point about inflation is a good one. At current levels, a bank account is like a leaky boat.

I'm already working on a Lemons car with the same cousin (a Starlet) so that base is covered.

Educating myself is a good idea also. Time to fill some knowledge gaps with a good book or two.

Fee for service financial planners are hard to come by. I asked my real estate agent if she had any recommendations. Her answer was to call her if I found one.

In reply to Javelin :

We wanted to but land here went nuts too

If the windfall amount is greater than your mortgage balance.. I'd seriously consider paying that sucker off. It may not technically be the best thing to do from a financial perspective but it'd allow me to sleep better.

The big thing is that there isn't ONE right thing. Spread the money around to take advantage of low hanging fruit from each option.

1. Pay off high-interest debt (credit cards)

2. Set aside an emergency fund that can cover your basic living expenses for 3-12 months. Having buffer cash is hugely beneficial to allow you to save money by paying expenses in lump sums instead of monthly payments with additional fees/interest tacked on, or to pay for significant bills that you might otherwise use credit for.

3. Budget modest amount for toys/vacation/luxuries/etc.

4. Pay off debt that is manageable, but greater than the average returns on a mutual fund. I.e. if your mortgage is 5%+, pay some of that down, but not if it's 2-4%

5. Invest in a long-term diversified portfolio making solid returns, that still allows you to pull money out if absolutely necessary (e.g. 401k, IRA, managed market account).

I know the "pay off the mortgage" is a hot button with most discussions about it, as there are opposite beliefs on it. That being said, I've never known anyone who is debt free to say "that's the dumbest thing I've ever done".

Steve_Jones said:

I know the "pay off the mortgage" is a hot button with most discussions about it, as there are opposite beliefs on it. That being said, I've never known anyone who is debt free to say "that's the dumbest thing I've ever done".

I mean I can say that but it would be a bold faced lie.

You can also hedge your bets and use half of the balance to pay down the principle on the mortgage, and put the other half in IRAs/mutual funds.

Paying off the mortgage became an even better idea when the SALT deduction was removed.

I calculate the periodic carried interest each month and make a payment that will get me to an exact round number (just paid April and I now owe $30,000 to-the-penny).

I'm on track to be 100% debt free this September when I'll be 58 and my eldest daughter starts college.

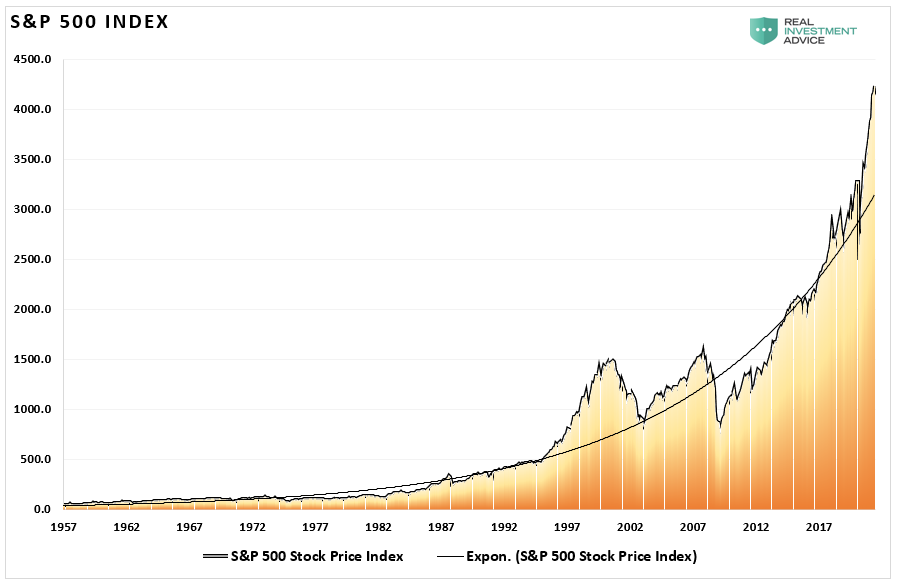

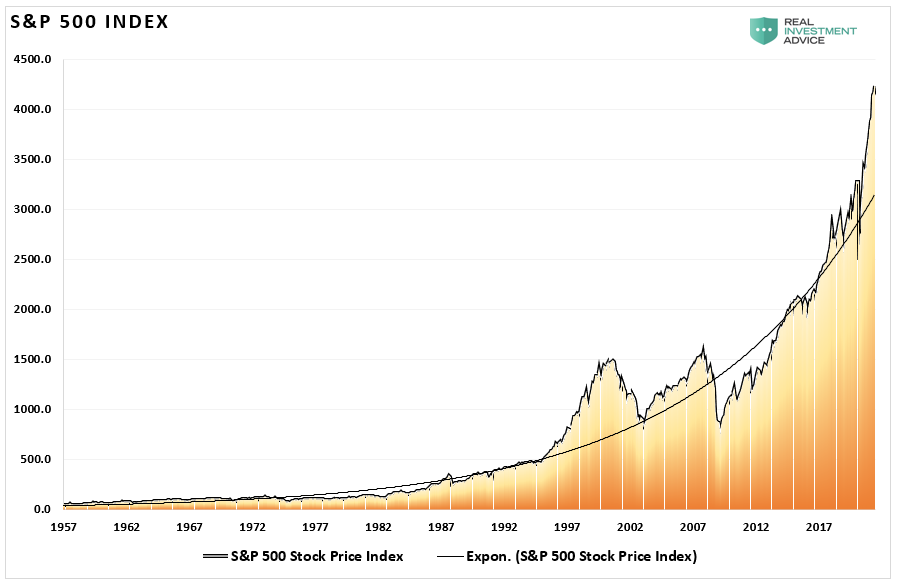

I've got a 30 year fixed at 3.625% interest...the S&P 500 has average 10.8% since it's current configuration was established in 1957. Sure, the math sez' to put my money in the stock market rather than paying off my loan but you get to a point where you have enough money so what's more important is risk reduction.

In reply to bobzilla :

Wifey and I focused on becoming debt free and today we are.

If my job ended or I fell over dead today the family is going to be fine.

Somebody mentioned feeling free? As we said in high school; berkeleying eh.

My (possibly rude) take: carrying CC debt suggests to this observer that your financial house is not quite in order. What's going to happen going forward that's going to keep you from dipping into that inheritance bit by bit until it's gone? This is a good opportunity to grow your wealth. Your distrust of the market is unfortunate here. It's very hard to lose long-term (if you cherry pick, you can find decade long stretches where it went nowhere) by investing in the S&P 500.

I'm more trusting of statisticians than I am financial advisors (even fiduciaries as they tend to be too risk adverse).

I don't keep large cash reserves...I don't try to time the market...I have zero bonds, annuities, etc..

I've pretty much just bought and held ultra low load S&P 500 index funds (VFINX, etc.) my whole life and at this point, the market could lose 50% and I'd still be ahead of where I'd be had I listened to the "experts".

If you're less than ten years away from retirement and don't have more than you need, you're kinda' screwed but if you've got a decent cushion, I see no reason to back off too much even in retirement.

If bond yields normalize to match "real" inflation, I'll go with a 75/25 or 80/20 stock/bond asset allocation but given the insane -7% inflation adjusted returns we currently have, berk it, I'll just stay 100% stocks.

I so somehow put this in the solar thread on accident, meant to go here...

Another idea is to invest some of the money into your home if you have the tax appetite to realize some of the tax breaks. Solar if you don't have it already, as the payback is pretty quick in your area. There are large credits for replacing windows, and appliance/ HVAC upgrades. The combined tax credits + energy bill savings can have a pretty good payback. Plus you get to improve your home.

I'm also leery of investing extra in the market right now, or buying property. While I live in a more affordable part of the Bay Area, house prices are nuts right now. I think we are overdue for a correction. I'm waiting on the sideline for the correction, ready to snap up a rental property. While I'm currently losing out to inflation, it's a much smaller percentage then I'm expecting to make on the other side. I don't Mind losing 7% if the market drops 25-30%. That said, I'm still maxing out my 401k and putting a bunch extra towards my house.

Repeating my suggestion with a bit more explanation:

What Are Treasury Inflation-Protected Securities (TIPS)? Treasury inflation-protected securities (TIPS) are a type of Treasury security issued by the U.S. government. TIPS are indexed to inflation in order to protect investors from a decline in the purchasing power of their money. As inflation rises, rather than their yield increasing, TIPS instead adjust in price (principal amount) in order to maintain their real value.

https://www.investopedia.com/terms/t/tips.asp

Sonic's idea of an I Bond is similar, but you're limited to $10K/year on those. (which are currently paying 7.12%)

These are US Gov't issued bonds, and so are relatively safe. Look for a fund that has a low expense ration (Vanguard for instance at .2%)

In reply to RX Reven' :

While I agree with you overall, I think there are a couple variables here that makes the historical statistics less applicable in this case.

1) There have been unique market forces that were not present through most of the above graph- namely the influx of individual traders. Many of the top stocks are grossly overinflated right now, where the value of the companies far outpaces what they could ever hope to produce. Huge bubble that is waiting to pop- historically would have popped already, if not for the influx of investors who kept it going.

2) Continuing to contribute regularly is different than putting a large lump into the market all at once. If you are putting in 10k a year for 10 years, your overall wins would be greater than your overall losses like your graph depicts. But if you just dump $100k in at one point, it's a bit of a gamble Vs. contributing consistently over time. If you did that right before the .com bust or housing bust, it would have taken years to get even. Sure you would have come out ahead eventually. But take that same 100k and put it in after the bust- you but a lot more stock (or property) for your money, and your long term gains are many times greater.

In reply to Captdownshift (Forum Supporter) :

Where? I can't find any cheap land commercial or otherwise. Sometimes, I can but barely.

RevRico

UltimaDork

3/18/22 5:40 p.m.

In reply to yupididit :

If you were looking to build a summer home or place to rent out in PA, I can find cheap residential land easily enough. It's commercial I've been having trouble finding.

In reply to RevRico :

PA too far north. I mostly look in the northern VA area, MD and Texas. I would love something in the mountains of WV or NC for the summer.

I might just try to acquire some multifamily units and rent them.

Boost_Crazy said:

In reply to RX Reven' :

While I agree with you overall, I think there are a couple variables here that makes the historical statistics less applicable in this case.

1) There have been unique market forces that were not present through most of the above graph- namely the influx of individual traders. Many of the top stocks are grossly overinflated right now, where the value of the companies far outpaces what they could ever hope to produce. Huge bubble that is waiting to pop- historically would have popped already, if not for the influx of investors who kept it going.

2) Continuing to contribute regularly is different than putting a large lump into the market all at once. If you are putting in 10k a year for 10 years, your overall wins would be greater than your overall losses like your graph depicts. But if you just dump $100k in at one point, it's a bit of a gamble Vs. contributing consistently over time. If you did that right before the .com bust or housing bust, it would have taken years to get even. Sure you would have come out ahead eventually. But take that same 100k and put it in after the bust- you but a lot more stock (or property) for your money, and your long term gains are many times greater.

Hi Boost_Crazy,

I totally agree with everything you said and would add that another source of market distortion (super high P/E ratio's relative to historical averages) is the horrible inflation adjusted bond yields of -7%. Everybody is getting herded into equities like cattle into the slaughter house.

I have a solution but it's not attractive...have much more than you need so you can ride out a big 20% to 30% market correction.

Although every point you made about what could tank the market is totally valid, the chart I posted reflects a multitude of threats (some similar / some unique). In other words, there's always a lot of things to worry about but the market has a brilliant track record of punching it's way through.

I can't promise that it won't be different this time but I'm nearing retirement and I'm so glad I never lost faith in the market and sold in fear.

I have two wonderful daughters that will one day take ownership of my money and I've taught them since day one to...