I was debating starting this thread, but as it's technically a build thread and could contain useful information, I decided to go for it.

A little bit of background: When I was 18, I got my first credit card, and promptly maxed it out on stupid E36 M3. When I was 19, I managed to get a Best Buy credit card and do the same. Well, come age 20, I needed to come up with money to pay my car insurance, and really wasn't doing very well keeping up on bills already, so I took out an unsecured loan from citifinancial for way more than I should have, paid insurance and should have paid the credit cards off, then promptly lost my job and had to live off the loan money for a while. It got refininanced every couple of years as I'd not be able to make a payment. The credit cards went to collections, and started a fun game of harrassing phone calls, threatens of lawsuits, and my personal favorite, getting passed to different collections agencies and starting from the beginning again.

In 2011, I cashed in my UGMA college fund that I didn't use on college, and paid off my collections agencies, leaving me with only the loan payment. 250 a month, every month, that I'd been making regularly.

Finally, last year, my grandfather died, and left me a joke of a life insurance policy compared to what had been explained and promised, and that legal battle is still going on, but it let me finally pay off the citifinancial loan.

All told, 10 years, and almost 40 thousand dollars to pay off $3500 in credit card debt and ~$9k that the personal loan had grown to. I decided berkeley credit at that point, but reality doesn't always work the way we expect.

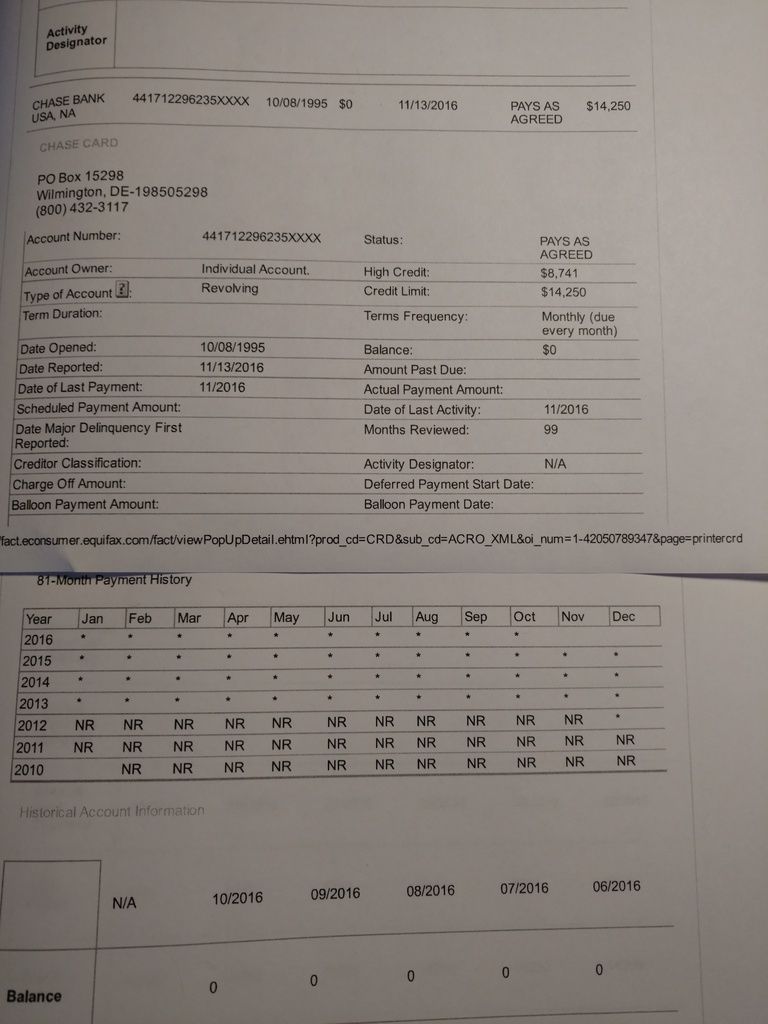

I've been keeping and eye on my credit karma though, and watching those two useless scores raise, level out, then begin to drop.

Present day

Earlier this week, I took a trip to my credit union and got started with a secured credit card. It has a $500 limit that I had to prepay, and only 12.99% interest rate that I find absolutely amazing compared to everything else I've been seeing or ever had that was in the 20%+ range.

The caveat of this card is that I HAVE to spend 150-300 per month on it(not gonna be hard with the work I have planned for the Miata), and wait to get the bill to pay it. Not a big deal waiting on the bill, 0% interest UNTIL a payment is late. This card also has the benefit of being reported to the credit bureaus EVERY month instead of just a few times a year.

I have not received the card in the mail yet, but logged into creditkarma just the same this morning, to see that my Best Buy card is officially off my Transunion report, and my score bumped up 60 points because of that. Leaving my Transunion at 637 and my Equifax a 639.

Most places that run your credit DON'T run those two specific agencies, but it gives me a good idea where I stand. Still technically "Poor" credit, but just barely below "Fair" which is 640.

I don't have crazy ideas about mortgages or car payments, at least not yet, but I want to get my credit somewhere respectable, so I can rent a car or get an Amazon or airline credit card and at least recover a little bit of what I spend.

I'm probably just going to post monthly updates to keep a record for myself, but I will happily answer any questions or hear about your experiences with this. This could also serve as a warning for those of you with kids entering the credit arena, although things aren't quite as screwy as they were back in 2005.

For a short term goal, I'm trying to get my credit rating high enough that I can take out a loan to EITHER buy a lift OR pour the concrete for my garage build. By spring, when I see that becoming a reality, I will already have plenty of cash saved up to pay for it, but in an effort to keep my credit building, I want a loan. Whether it's secured or unsecured shouldn't matter if I have the cash to back it up.

Welcoming all suggestions, questions, and complaints.