z31maniac said:I think part of this weird "I should have a big, nice new home right after graduating college" mindset is coming from housing for college students now. From the past few years of being season ticket holders for OSU football games, on-campus housing is a nicer than what a lot of people who have graduated and have full-time jobs live in normally.

College housing is obscene these days. Even 15 years ago it was way too nice. Just another example of how our ever-changing standards of living make it impossible to directly compare to the past.

ProDarwin said:Steve_Jones said:GameboyRMH said:Actually knew a guy who had that kind of lifestyle, I'd give him a ride home from university sometimes when his one really cheap vehicle was broken down, I wonder what he's up to these days...You say that like he's the idiot, I can guarantee he's not complaining about how "the system" is stacked against him.

Eh, I'm sure there is nuance to the situation, but I would argue that buying a home you can just barely afford, i.e. hinges on you making major sacrifices everywhere else is a terrible idea. That sounds like a situation where he could be one step away from it all crashing down.

That said, I do agree with the general consensus here.

The #1 factor is still location. Eventually we will reach a threshold where workers will not want to/be able to live near employers at whatever salary they are offering. I thought that would've happened a long time ago (it happened to me over a decade ago), but *shrug* here we are. I'm really not sure what its going to take to convince people to just move. Capitalism is trying to self correct but irrational employees are messing up the algorithm. (I do recognize this is easier said than done for those in very low income jobs)

That's what I was trying to explain before. When you can afford a property only if you're one of the top earners in your age group, people start to look into their options. And that usually means moving to another country for better opportunities.

A friend of my father, Romeo, now in his 70's, left Italy in the sixties because life was too expensive and he could never afford a home or a car while working a "normal" job. He was an upholsterer by trade. He came here and found a good job in his trade. He made a good living, bought a house, had kids then grand-kids.

Meanwhile, his brother, also an upholsterer, stayed in Italy. And until about 10-15 years ago, Romeo had a "better" life than his brother who lived in an apartment, was never able to afford to travel or have a car. But with the crashing Italian real estate, his brother has since been able to buy a duplex and a vacation property.

And about a year ago, Romeo's youngest daughter, who was born and raised in Canada, as decided to move to Italy in the search for better opportunities.

All I'm saying with this example is that the younger generations are presented with two option: stay here, tough it out and hope for better days or leave in the hopes of better opportunities elsewhere. And I'm pretty sure a lot of them will choose to leave. It's not a change that will happen quickly, but when it starts, it's very hard to stop. There have been many examples of this. Italy is just one. And it comes with pretty harsh consequences. A crashing real estate market is one of the smallest.

I don't think the government can do anything about it.

I promised I was out but...

We built what we thought would be our forever home in 2004. The struggles we went through on that were not little. Finding the right property, and a seller that wasn't a douche canoe, people we did buy from trying to back out last second. Construction started and the Electric company that had removed the poles 5 months before wanting to charge us almost $50k to bring us power back to the property when we were already stretched to the limit. Finally got the house built, we depleted all the money we had and were literally living paycheck to paycheck for what we knew would be at least 18 months. We did nothing for 6 months. We allowed ourselves one meal out per month under $20. We didn't settle, I worked all the OT I could get my hands on. Wife worked a second job over the next 2 summers. My "hobbies" at that time were cleaning the vehicles because I still had cleaning supplies, taking the dogs on walks and working. By 2006 we finally were at a place we could start doing things again but were still cautious and the question "Do we need it or want it? was asked on a continual basis.HEll we still ask that question and we could both stop working for a couple years if we wanted.

It ain't easy. It was never intended to be easy.

Also, Gameboy's problems are also mainly Canadian problems. So no, what is happening in the US in certain locales has nothing to do with his over taxed, over priced society.

I said what I needed to say, continue on with your whining and crying about how unfair life is. I'll just be over here living it and making the best of every situation I can

maschinenbau said:As a millennial, my home-buying power sure feels bad compared to my parents' generation.

A lot of the comparisons I see are weird. They are along the lines of "I could never afford the house I grew up in".

The house I grew up in was purchased on the edge of the DC metro area in 1981. Since then the "edge" of the metro area has moved out another 30+ miles. A house in the middle of a county of >1 million people isn't really comparable to a rural/semi rural neighborhood.

In reply to GameboyRMH :

My first house was 1100 sqft and built in the 1920s. It was a E36 M3ty little house in a E36 M3ty area and it was cheap. At the time I was driving a rusty old Toyota Corolla that I bought for $350 with a blown clutch. I was making about $8/hr. I will admit that my father helped me with the loan but paying for it was all on me. We lived in that house for 25 years because it's what I could afford. 4 kids in a 2 bedroom 1 bath 1100 sq-ft house was less than fun at times.

In my mid-30s, I had an epiphany. No one was going to change my circumstances other than me. If I wanted change, I would have to do it. If you want something, go out there and do what is necessary to get it. So that's what I did. I changed industries and went from an easy retail job to a construction job in a new trade. It was way outside of my comfort zone but that's what it takes. Three years later I realized that northern corporations don't understand how to do business in the south. With that realization, I stepped even farther outside my comfort zone and opened my own business. At 38, I had zero income other than what my wife was bringing in driving a cab. It may have been the hardest thing we have ever done. It was terrifying. IIRC, my income that first year was about $18k. I have made sacrifices to be where I am. I have done the 2 a.m. car repairs to make it to work in the morning because all I could afford were E36 M3ty cars. I have been that poor shmuck who ate beans and rice because that was all the budget could afford. I decided I didn't like that, so I changed. I didn't expect the world to change to suit me, I changed to suit it.

I have a friend who went the other way. He sits around and blames everyone else for his problems. He works a dead-end job and bemoans that he doesn't have a house or a nice car. We had dinner together the other day and I realized we have almost nothing in common anymore. He has his hand out palm up, wanting more. I have my hand out as well, but mine is palm down doing the necessary work to earn more.

There are two ways you can spend your energy in life. Going after what you want, or complaining about what you don't have. One of them will take you anywhere you can imagine, the other is a pair of chains that keep you where you are. Those chains aren't placed by anyone but yourself and you are the only person who can remove them. The man isn't keeping you down. Stop blaming him.

ProDarwin said:maschinenbau said:As a millennial, my home-buying power sure feels bad compared to my parents' generation.

A lot of the comparisons I see are weird. They are along the lines of "I could never afford the house I grew up in".

The house I grew up in was purchased on the edge of the DC metro area in 1981. Since then the "edge" of the metro area has moved out another 30+ miles. A house in the middle of a county of >1 million people isn't really comparable to a rural/semi rural neighborhood.

Exactly what I mean. The same houses in the same locations aren't the same anymore over time.

ProDarwin said:maschinenbau said:As a millennial, my home-buying power sure feels bad compared to my parents' generation.

A lot of the comparisons I see are weird. They are along the lines of "I could never afford the house I grew up in".

The house I grew up in was purchased on the edge of the DC metro area in 1981. Since then the "edge" of the metro area has moved out another 30+ miles. A house in the middle of a county of >1 million people isn't really comparable to a rural/semi rural neighborhood.

The more important question at that point would be "was the house you grew up in the first house they bought, or was the starter house smaller?"

One of the issues is people now want to start at 2nd base.

Steve_Jones said:ProDarwin said:maschinenbau said:As a millennial, my home-buying power sure feels bad compared to my parents' generation.

A lot of the comparisons I see are weird. They are along the lines of "I could never afford the house I grew up in".

The house I grew up in was purchased on the edge of the DC metro area in 1981. Since then the "edge" of the metro area has moved out another 30+ miles. A house in the middle of a county of >1 million people isn't really comparable to a rural/semi rural neighborhood.

The more important question at that point would be "was the house you grew up in the first house they bought, or was the starter house smaller?"

One of the issues is people now want to start at 2nd base.

That's why I brought up the college housing part. When I started college even in 2000, all the dorms at OSU, were what you think of. Two people in a small room, with a shared bathroom for the entire floor.

After I graduated college I spent a year in Vail. Made decent money delivering pizza's and lived with 3 other room mates. Didn't know what I wanted to do, moved back in with college room mates, got a job doing software support. Made maybe $24k. Looked at my boss, who'd been doing it 30+ years and decided I didn't want that future. Went and interviewed all my Dad's friends to try and figure out what I wanted to do. Decided to be a dentist, moved back home, took all the pre med classes then went to dental school. Graduated with a ton of debt.

After that I went active duty, lived on less money a month then I did while in school, because school loans. A few years later my then girlfriend, now wife and I bought our first home, a 1200 sq ft "Cape Cod" house in a starter neighborhood. Did all the work ourselves. Decided to move to Colorado, even though I desperately wanted to move home to San Diego because we couldn't afford San Diego. Let me repeat that, we made a conscious decision to move to a place we could afford vs the place I *really* wanted to move.

Sold the starter house when we moved to Colorado and bought our next house, then sold that and bought the house we're in now after we'd been in a rental for 6+ months. Ever since we've been in Colorado (so the last 20 years) I've worked at least two jobs and my wife has worked too.

So look at where you are. Assess it. Look at where you'll think you're going to be in 5-10-15 years. Like that? No? Then go and do something about it, nobody is going to give you anything and nobody owes you anything. Make whatever changes you need to make. Work more. Save more. Maybe move to a more affordable place. Start with a small house, then go from there.

In reply to GameboyRMH :

The methodology may have been questionable but the results happen to be generally correct. Here are some summaries of other studies that come to the same general conclusion: that most millennials aren't choosing not to buy homes because they don't feel like it, but because they can't afford them:

No, they are not correct. As others have mentioned, self reporting on whether one can afford a home is not very reliable. If you read into the links that you provided, they can't afford homes because...

1) They have made poor choices that led to debt, which delays home ownership.

2) They want homes that are out of their price range. In more desirable areas, or a step above starter homes.

3) They are unwilling to make lifestyle changes to prioritize home ownership. Saying you want to own a home and doing what is needed to make it happen is not the same thing.

https://www.vox.com/the-goods/2018/10/10/17959808/millennial-homeownership-student-loans-rent-burden

Summary- Millennials want to buy homes in the cities where they are more expensive, have a lot of debt, are scared to the point of paralyzation over the state of the economy, fearful of another crash. They are also largely ignorant on what kind of a down payment it takes to buy a home.

https://www.creditkarma.com/home-loans/i/millennial-homebuying

Summary- Houses are expensive, too much debt, poor credit scores, lending standards are tighter, and they may not need a home in the first place because they are delaying or simply not getting married and having children.

https://financialpost.com/real-estate/canada-millennials-homeownership-relocating

Summary- “A huge number of millennials are telling us, `Yes, if I move, I could own my home,’

Summary- Another article based on feelings and poor methodology. They polled 1500 people- non homeowners- between the ages of 20 and 40, and asked them "How do you feel about housing affordability?" Their choices were furious, frustrated, angry, resigned, hopeful, or other. No details on the age mix- 20 is very different than 40. Not very scientific, this poll.

As a millennial myself, I feel this is akin to citing evidence to support the idea that most people step on Lego bricks barefoot by accident rather than doing it intentionally as a sport.

Yes, but if you walked by the Lego brick previously and failed to pick it up, that's on you. If you keep stepping on it and continue to blame the brick, I really can't help you.

Every generation thinks their challenges are unique. But they have a lot in common, and the solution to many problems have been solved by the previous generations. There is already a template, that multiple generations ahead of you have shared. It will work for your generation, and the next, and the next.

I got serious about buying my first home around 2002. Houses were really appreciating then, we were on the upward slope of the bubble. I remember the house I wanted, pretty much all I could "afford." It was a fixer upper for around $175k, a huge number at the time. My Mom had bought a much nicer house for $150k just a couple years prior. I wasn't quite ready, I still had to clear up some debt and save more for the down payment. In the mean time, house prices climbed at a record pace. The more I tried to save, the more money I needed. I saw my prospects as a homeowner accelerating away, leaving me in the dust. I could have given up. Instead, my wife and I changed our spending habits and took on extra work. I don't think I saw my wife much that year. We caught up to the housing market and bought our first house in 2003 for $265k, just over a 50% increase from less than 2 years prior. 20 years later, it was still one of the best decisions we ever made. Maybe second to maxing out our 401k contributions.

Boost_Crazy said:If you keep stepping on it and continue to blame the brick, I really can't help you.

That sums it up.

For anyone who may be interested in the wider issue rather than pivoting to why one particular person with at least median income and below-median expenses is still too much of a lazy bum by today's standards to afford home ownership, I ran across an organization that produces a report anually on home affordability in the US. One of the points that came up earlier in the discussion was the argument that the issue was not systemic in the US because not every area of the US was affected. Of course probably only a few small countries have a housing affordability issue with 100% nationwide coverage (I moved away from one, but again I don't want this to be about me). This raises the question of just how many areas in the US are affected. According to this report, it's about 66% right now:

Down from 70% in 2019:

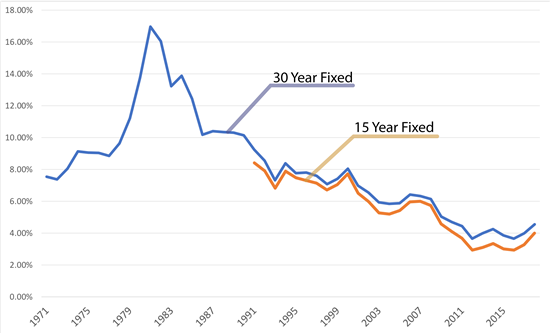

Some other recent news I thought was interesting, Americans freaking out about mortgage rates being in the 5-8% range or *gasp* even higher!

https://www.cnn.com/2023/10/20/homes/housing-market-challenges/index.html

Now it may be something of a coincidence, but looking at the historical data, when housing was affordable rates tended to be in the 6-11% range, and anywhere under 5% is near a low point in modern American history:

Of course if you look at the big picture, mortgage rates above historic lows are going to instantly feel like a crisis combined with the much higher cash value of homes today.

I have to point out none of us are saying you're a lazy bum. The point we're making is that you have the power to do something, instead of pissing into the wind and moaning that things should reset to the way they were 60-80 years ago.

In reply to docwyte :

If we were to reset to 60 years ago, Mr Gameboy would definitely be unemployed. There were no IT people at all!

In reply to SV reX :

60 years ago I would've crushed it, that was a golden age of private practice dentistry

In reply to verifybtc09 :

Pretty sure that's a copy/paste of a previous comment. Do you have a canoe I can borrow to try to find a bar across the river?

docwyte said:In reply to SV reX :

60 years ago I would've crushed it, that was a golden age of private practice dentistry

60 years ago I'd still be doing exactly what I'm doing today.

When I asked my Dad what made him decide to be a Millwright, he said, I was working in a forge, and every day I saw the same couple of guys standing around drinking coffee, and decided that was what I wanted to be doing

You'll need to log in to post.